In today’s fast-paced global market, logistics is the backbone of industries dealing with high-value goods, from luxury electronics to fine art and high-tech medical equipment. As these items move through the supply chain, they are exposed to various risks, including damage, theft, and delays. While many logistics providers offer robust services, even the most reliable systems can’t guarantee complete protection. This is where insurance becomes crucial.

“Being prepared does not make the crisis disappear! Even if you’re ready, it’s still there, only in more manageable proportions.”

— Chris Hadfield, Canadian Astronaut

What is Insurance in Logistics?

Insurance in logistics refers to a policy that protects the value of goods being transported. This insurance covers a range of potential risks that goods might face during their journey from the point of origin to the destination. In the context of high-value logistics, insurance is not just a safety net; it’s a critical component of risk management.

Logistics insurance can cover a variety of scenarios, including loss, damage, and delays due to unforeseen events like natural disasters or accidents. Depending on the value of the goods, logistics providers and clients might opt for different levels of coverage, from basic coverage for general goods to specialized policies tailored for high-value items.

| Type of Coverage | Description | Suitable For |

|---|---|---|

| Basic Coverage | Covers general risks such as loss or damage to goods during transit. Ideal for lower-value items or standard shipments. | General goods, non-perishable items |

| Specialized Coverage | Provides higher levels of protection, including coverage for delays, natural disasters, and accidents. Tailored for high-value goods. | High-value items, luxury goods, perishable items |

| Custom Coverage | Designed to meet specific needs, such as coverage for fragile items, temperature-sensitive goods, or items with unique risks. | Fragile goods, temperature-controlled items, specialized shipments |

Why is it Important to Insure High-Value Items?

When dealing with high-value items, the stakes are significantly higher than with standard shipments. These items are often irreplaceable or would be prohibitively expensive to replace. Here’s why insuring high-value items is essential:

-

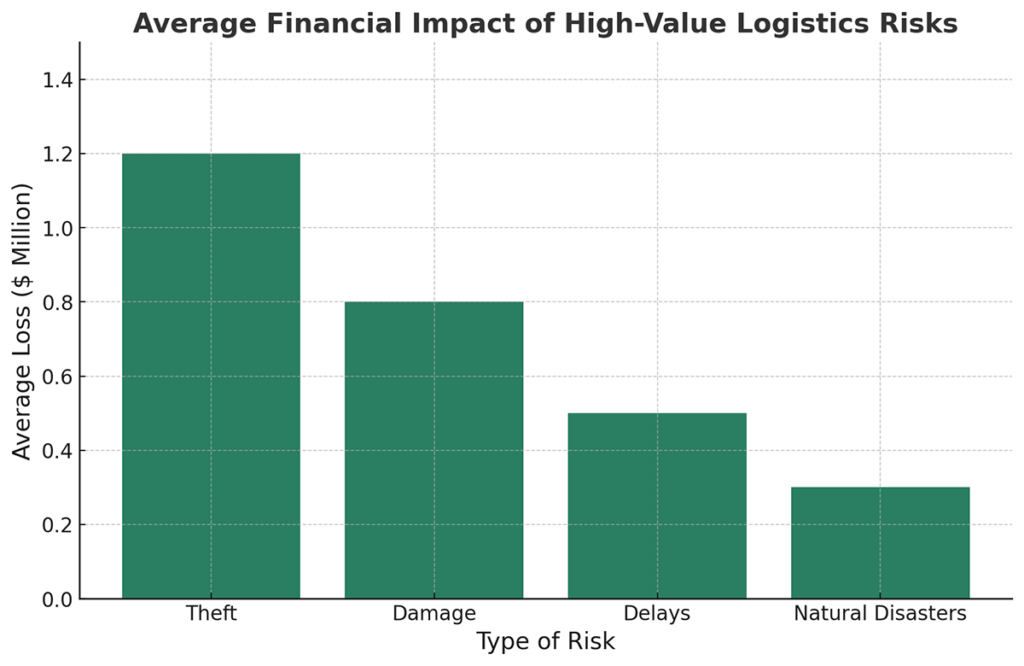

- Financial Protection: The primary reason for insuring high-value goods is to protect against financial loss. According to the FBI, cargo theft in the United States resulted in losses exceeding $100 million in 2020 . The following graph shows the average financial impact of different types of risks in high-value logistics: As illustrated, the financial impact of theft is particularly significant, with average losses reaching up to $1.2 million, highlighting the importance of comprehensive insurance coverage.

- Mitigation of Risks: High-value items are more susceptible to theft and damage. Insurance helps mitigate these risks by ensuring that, even if something goes wrong, the financial impact is minimized.

- Client Assurance: Insuring high-value goods provides peace of mind not just for the logistics provider but also for the client. Knowing that their valuable items are protected makes clients more likely to trust and continue doing business with you.

- Regulatory Compliance: In some industries, insuring high-value shipments is not just recommended—it’s mandatory. The percentage of logistics providers in the United States that comply with insurance regulations are high across the U.S., with many providers adhering to stringent regulations to ensure their operations are legally protected.

[1] Source: Federal Bureau of Investigation (FBI), 2020 Cargo Theft Report.

Disclaimer: The data presented in this graph is based on estimates and reported figures from 2020. The financial impact of logistics risks can vary based on industry, region, and other factors. For the most accurate and up-to-date information, please consult relevant industry reports or speak with a logistics insurance professional.

What Are High-Value Items?

High-value items refer to goods that carry significant financial worth or possess unique characteristics that make them irreplaceable or extremely costly to replace. These items often include, but are not limited to, luxury goods, sensitive electronics, fine art, medical equipment, large heavy items, and precious metals. The intrinsic value of these items means that even minor damage or loss can result in substantial financial loss.

Some common examples of high-value items include:

-

-

- Film and Production Supplies

- Aerospace Parts and Equipment

- High-End Electronics (e.g., servers, specialized technology devices)

- Medical Equipment

- Banking Equipment

- Pharmaceuticals and Biotech Products

-

What Type of Risk Cannot Be Insured?

While insurance is an essential tool in high-value logistics, it’s important to understand that not all risks can be covered. Here are some examples of risks that typically fall outside the scope of standard logistics insurance:

-

-

- Inherent Vice: This refers to the natural characteristics of an item that make it susceptible to damage. For example, fruit that spoils during transport due to its natural perishability may not be covered under standard insurance policies.

Solution: To cover such circumstances, specialized insurance known as “Perishable Goods Insurance” or “Spoilage Coverage” can be purchased. This type of insurance is specifically designed to protect against losses related to the deterioration of perishable goods during transit, provided that all shipping and storage conditions are met. - War and Terrorism: Many insurance policies exclude coverage for damages or losses caused by war or acts of terrorism, unless specific coverage is purchased.

Solution: “War Risk Insurance” and “Terrorism Insurance” are specialized policies that can be added to standard logistics insurance. These policies offer protection against losses or damages resulting from war, civil unrest, or terrorist acts. Companies dealing with international shipping, especially in volatile regions, may opt for this additional coverage.

Coverage for Terrorism is Available - Negligence: If the loss or damage is due to negligence by the shipper or logistics provider, it may not be covered by insurance. This could include improper packaging or failure to follow safety protocols.

Solution: To manage risks associated with negligence, businesses can purchase “Errors and Omissions Insurance” (E&O). This type of insurance covers legal costs and damages if the logistics provider is found liable for mistakes or oversights that lead to loss or damage. In addition, some shippers will offer cargo insurance or valuation coverage to assist in the event of damage to the goods.Pro Tips: Not all freight companies offer cargo insurance, and some of the ones that do may not make the offering clear when during the booking process. Include this request in your freight booking process if you opt for cargo insurance.

Most freight companies that do offer cargo coverage require that the insurance is listed on the BOL (Bill of Lading), and if not they won’t cover it. Review all documents before the shipment is tendered.

Many standard freight companies will offer free insurance or something that is included with every shipment as no extra charge. The coverage is quite often falls into the category called “release value” and may only cover the goods to a maximum of say .50 per lb. Full Value Protection is sometimes the better choice but usually comes at t a premium.

- Inherent Vice: This refers to the natural characteristics of an item that make it susceptible to damage. For example, fruit that spoils during transport due to its natural perishability may not be covered under standard insurance policies.

-

Understanding these exclusions is crucial for logistics managers, as it helps in planning and mitigating risks that might not be covered by standard insurance policies. By purchasing specialized coverage, businesses can ensure a more comprehensive protection strategy, addressing the specific vulnerabilities of high-value items during transport.

Who is Liable When an Insured Suffers a Loss?

Determining liability in the event of a loss is a complex issue in logistics. When an insured item is lost or damaged, the first step is to assess where the liability lies. Liability can fall on various parties, including:

-

-

- The Logistics Provider: If the loss is due to the negligence or failure of the logistics provider to adhere to safety standards, the provider may be held liable. For example, if a shipment is damaged because the logistics company failed to properly secure the goods, the provider could be responsible.

- The Carrier: If the carrier (e.g., shipping company) was responsible for the goods during transit, they might be held liable for losses, especially if the damage was due to their mishandling or an accident caused by their negligence.

- The Client: In some cases, the client might be liable, particularly if they provided incorrect instructions or failed to properly declare the value of the goods.

-

Insurance plays a critical role in determining liability and ensuring that the affected party is compensated for their loss. However, the specifics of liability can vary depending on the terms of the contract and the nature of the incident. In such complex situations, consulting with a specialized attorney can be invaluable.

The Role of a Transportation or Logistics Attorney

When disputes arise over liability in high-value logistics, a transportation or logistics attorney is often the best resource. These attorneys specialize in the laws and regulations governing the transportation industry, including the responsibilities of carriers, logistics providers, and clients. They are well-versed in handling cases involving:

-

-

- Contract Disputes: Clarifying and interpreting the terms of contracts between shippers, carriers, and clients to determine liability.

- Claims and Litigation: Assisting in filing claims against liable parties and representing clients in court if disputes escalate to litigation.

- Regulatory Compliance: Ensuring that all parties adhere to industry regulations, which can impact liability and the outcome of claims.

-

In high-value logistics, where the stakes are particularly high, having an experienced transportation attorney can help navigate the complexities of liability. They can provide legal guidance on how to structure contracts, handle claims, and mitigate risks, ensuring that your business is protected in the event of a dispute.

What is the Difference Between a Claim and a Loss?

In logistics, the terms “claim” and “loss” are often used interchangeably, but they refer to different stages of the insurance process:

-

-

- Loss: This refers to the actual event where goods are damaged, lost, or otherwise compromised. A loss is the incident that triggers the need for a claim.

- Claim: A claim is the formal request made by the insured party to the insurance provider for compensation after a loss has occurred. The claim process involves submitting evidence, such as proof of value and documentation of the incident, to substantiate the loss and receive compensation.

-

The efficiency of the claims process is critical in high-value logistics. A streamlined and responsive claims process ensures that businesses can recover from losses quickly and continue their operations with minimal disruption.

Claim vs. Loss: Key Differences

| Aspect | Loss | Claim |

|---|---|---|

| Definition | The event where goods are damaged, lost, or compromised. | The formal request for compensation made after a loss has occurred. |

| Trigger | Incident of damage or loss of goods during transit. | Filing of documentation and proof after the loss is identified. |

| Action Required | Identify and document the loss. | Submit a claim to the insurance provider for compensation. |

| Outcome | Goods are lost, damaged, or compromised. | Insurance provider processes the claim and provides compensation if approved. |

| Importance | Understanding the loss helps in assessing the impact on business operations. | The claim process is crucial for financial recovery and continuity of operations. |

Safeguard Your High-Value Shipments with Comprehensive Insurance

Insurance in high-value logistics is not just a precaution—it’s a necessity. Whether you’re shipping luxury goods, sensitive electronics, or irreplaceable artifacts, the risks involved in their transport are too significant to ignore. By understanding the types of insurance available, the risks that can and cannot be insured, and how liability and claims work, logistics managers can better protect their valuable shipments and ensure smooth, uninterrupted operations.

By integrating comprehensive insurance coverage into your logistics strategy, you not only protect your business from financial loss but also build trust with your clients, offering them the assurance that their valuable goods are in safe hands. As the logistics landscape continues to evolve, the role of insurance will only become more critical, making it an indispensable part of high-value logistics operations.

Trust Moveitem.com

More Great Resources from our Team to You.

Case Study | Nationwide Shipping Service

Posted By

Clint Lawrence, founder of MoveItem.com. Helping give customers Safe, Simple, and Sustainable Shipping Solutions.rever